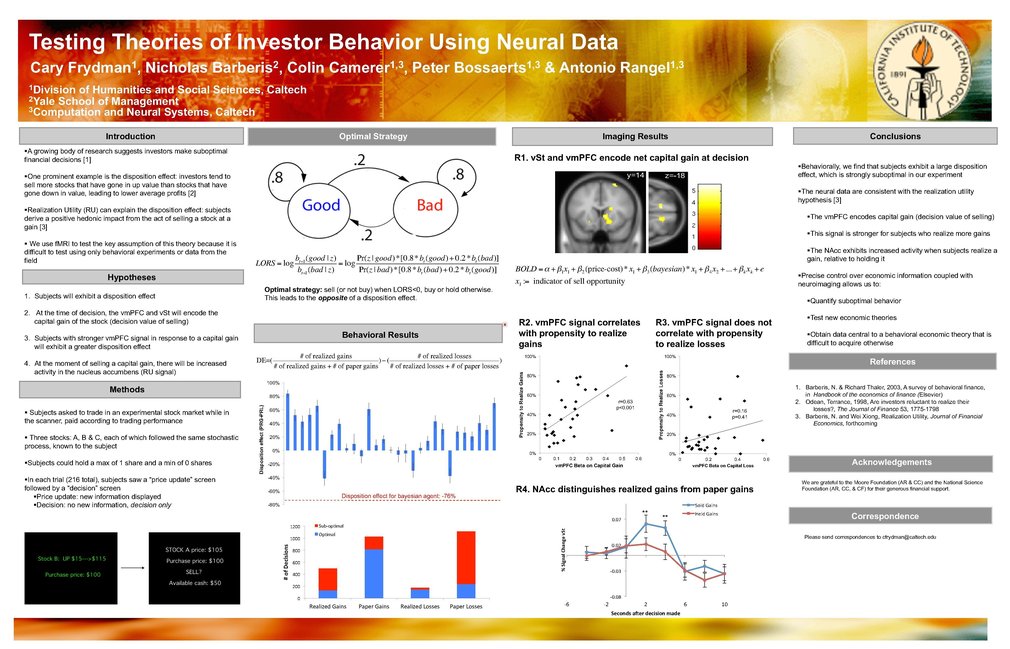

Neurofinance: Testing Theories of Investor Behavior Using Neural Data

We show that measures of neural activity provided by functional magnetic resonance imaging (fMRI) can be used to test between theories of investor behavior that are difficult to distinguish using behavioral data alone. Subjects traded stocks in an experimental market while we measured their brain activity. Behaviorally, we find that, our average subject exhibits a strong disposition effect in his trading, even though it is suboptimal. We then use the neural data to test a specific theory of the disposition effect, the “realization utility” hypothesis, which argues that the effect arises because people derive utility directly from the act of realizing gains and losses. Consistent with this hypothesis, we find that activity in an area of the brain known to encode the value of decisions correlates with the capital gains of potential trades, that the size of these neural signals correlates across subjects with the strength of the behavioral disposition effects, and that activity in an area of the brain known to encode experienced utility exhibits a sharp upward spike in activity at precisely the moment at which a subject issues a command to sell a stock at a gain.

Judges and Presenters may log in to read queries and replies.