Trading Blind: Information Percolation in a Discrete Decentralized Market

A market is a mechanism through which agents interact to improve their outcomes. Many markets are centralized- all agents transact in a single environment at a single price, and there is no uncertainty as to the relative values of goods (complete information). Decentralized markets are environments in which agents meet in groups, bargain over a transaction, then separate. A prime example of this is when parties exchange financial assets in pairs; individuals outside the two parties cannot see or learn from the prices or quantities at which that trade occurs.

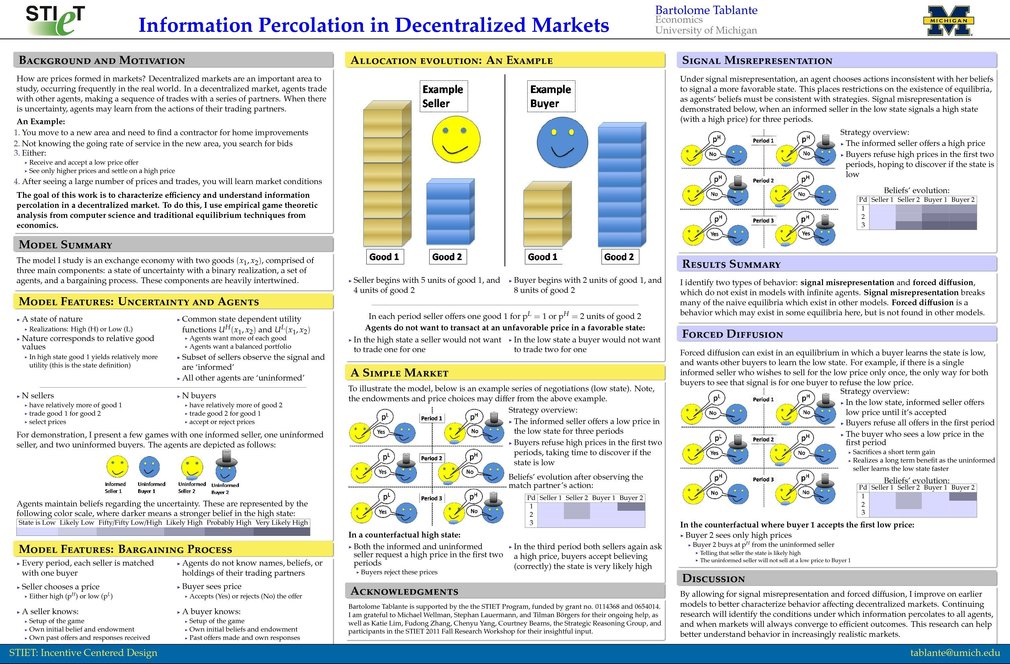

This project studies a theoretical model of two possible attributes of a decentralized market environment: incomplete information and finite agents. Many models employ infinite agents so no individual agent can impact the whole market. By instead considering finitely many agents, an individual may affect the whole market. Under incomplete information, agents receive different information about the relative values of goods.

These two features have not been studied in tandem; I do so in a traditional decentralized market model, modified so that agents make several trades, and simplified for tractability. I analyze this model using traditional economic theory as well as numerical game theoretic equilibrium techniques from computer science. This allows for consideration of long term strategies where agents may choose short term losses to manipulate others’ beliefs and increase the potential for long term gains. I show how these strategies, impossible under an infinite agent assumption, can significantly impact market outcomes and help better understand behavior in increasingly realistic markets.

Trading Blind: Information Percolation in a Discrete Decentralized Market

A market is a mechanism through which agents interact to improve their outcomes. Many markets are centralized- all agents transact in a single environment at a single price, and there is no uncertainty as to the relative values of goods (complete information). Decentralized markets are environments in which agents meet in groups, bargain over a transaction, then separate. A prime example of this is when parties exchange financial assets in pairs; individuals outside the two parties cannot see or learn from the prices or quantities at which that trade occurs.

This project studies a theoretical model of two possible attributes of a decentralized market environment: incomplete information and finite agents. Many models employ infinite agents so no individual agent can impact the whole market. By instead considering finitely many agents, an individual may affect the whole market. Under incomplete information, agents receive different information about the relative values of goods.

These two features have not been studied in tandem; I do so in a traditional decentralized market model, modified so that agents make several trades, and simplified for tractability. I analyze this model using traditional economic theory as well as numerical game theoretic equilibrium techniques from computer science. This allows for consideration of long term strategies where agents may choose short term losses to manipulate others’ beliefs and increase the potential for long term gains. I show how these strategies, impossible under an infinite agent assumption, can significantly impact market outcomes and help better understand behavior in increasingly realistic markets.

9905 Views

-

Further posting is closed as the event has ended.

Judges and Presenters may log in to read queries and replies.